ICT Timestamps – Mentorship 2022 Episode 3 | Full Study Notes + Glossary

📌 These are my personal study notes from Episode 3 of ICT’s “2022 Mentorship” series. All credit belongs to ICT. I’m a student sharing how I study and apply his lessons — especially in Forex using mechanical strategies.

🎯 ICT Mentorship Episode 3 – Timestamped Clickable YouTube Links

| Timestamp | Topic | Direct Link |

|---|---|---|

| 00:17 | Introduction & Lecture Topic | Watch at 0:17 |

| 01:14 | Chart Walkthrough Begins | Watch at 1:14 |

| 02:12 | Sell-Side and Buy-Side Liquidity | Watch at 2:12 |

| 03:05 | Market Structure Shift vs Break | Watch at 3:05 |

| 06:31 | High-Frequency Algorithms | Watch at 6:31 |

| 13:05 | Order Blocks Explained | Watch at 13:05 |

| 18:00 | Intraday Trade Logic | Watch at 18:00 |

| 33:00 | Key Session Times | Watch at 33:00 |

| 35:02 | Internal Range Liquidity | Watch at 35:02 |

| 40:05 | Backtesting Homework | Watch at 40:05 |

| 41:06 | Live Trading Example Begins | Watch at 41:06 |

| 52:14 | Conclusion | Watch at 52:14 |

📝 Timestamped Study Notes

00:17 – Introduction & Lecture Topic

ICT introduces two major topics for this episode: Internal Range Liquidity and Market Structure Shift (MSS) — two of his most critical building blocks for reading price action.

01:14 – Chart Walkthrough Begins

ICT breaks down a 15-minute Nasdaq chart, identifying old lows and equal highs, emphasizing the constant presence of buy-side and sell-side liquidity pools.

02:12 – Sell-Side and Buy-Side Liquidity

- Sell-Side Liquidity: resting stop orders under old lows.

- Buy-Side Liquidity: resting stop orders above equal highs.

- Price constantly hunts these pools — grabbing one side and then often targeting the opposite.

03:05 – Market Structure Shift vs Break

ICT clarifies an important distinction:

- Market Structure Break (MSB): long-term bias shifts.

- Market Structure Shift (MSS): short-term intraday reversals after liquidity grabs.

- Intraday shifts are actionable for day traders; breaks imply longer moves.

06:31 – High-Frequency Algorithms

High-frequency algorithms (HFTs) hunt liquidity on micro-timeframes (3m, 2m, 1m, even sub-minute). ICT explains:

- Algorithms trigger once liquidity is cleared.

- Short-term swing highs/lows define algorithmic state shifts.

13:05 – Order Blocks Explained

ICT defines his core “Order Block” concept as a change in state of delivery:

- Example: Bullish Order Block forms when price closes below liquidity, then reclaims that zone.

- Key location for precise entries when aligned with MSS and FVG.

18:00 – Intraday Trade Logic

ICT shows how traders can apply MSS + Liquidity + Order Blocks intraday, using Nasdaq as illustration but emphasizes full cross-asset relevance (Forex included).

33:00 – Key Session Times

ICT defines the 3 critical trading windows:

- London: 02:00 – 05:00 (NY time)

- New York: 07:00 – 10:00 (NY time)

- Asia: 19:00 – 21:00 (NY time)

35:02 – Internal Range Liquidity

Internal range liquidity = short-term highs and lows within price legs that hold stop orders or imbalances. These act as intraday targets.

40:05 – Backtesting Homework

ICT challenges students to manually annotate intraday MSS setups from past data:

- Targeting stop hunts + structure shifts

- Journaling patterns across 3m, 2m, 1m charts

- Building pattern recognition via repetition

41:06 – Live Trading Example Begins

ICT demonstrates live executions using TD Ameritrade + TradingView — reinforcing his process:

- Liquidity grab → MSS → FVG → Trade entry → Partial exits.

- Real-money executions provide confidence in the repeatability of his model.

52:14 – Conclusion

- Simplicity wins.

- Master liquidity, structure shifts, timing.

- Deep backtesting builds confidence.

- Ignore outside noise; focus on the algorithmic model.

📊 Forex Adaptation: How I Apply ICT’s Concepts

While ICT teaches Nasdaq futures, I apply his system directly to Forex pairs like EUR/USD and GBP/USD. The core logic is fully transferable.

My Mindset

- Study structure, not signals.

- Trade mechanically, not emotionally.

- Accept uncertainty — follow probabilities.

Demo vs Live

- I use both demo and live accounts.

- Track every trade via my mechanical system for repeatability.

Simplification Toolkit

- Fair Value Gaps (FVG)

- Session windows

- Liquidity pools

- Confirmation candles

- MSS validation

Session Timing (Forex Translation)

| ICT Session | My Stockholm Time |

| Frankfurt-London | 07:00 – 11:00 |

| NY Overlap | 13:00 – 16:00 |

Strategic Reasoning

- Frankfurt often triggers early liquidity sweeps.

- London Open completes Judas swings.

- NY Open reflects US data shocks (ICT’s 08:30 focus).

My Core Mechanical Rules

- No trades outside defined sessions.

- MSS must align with liquidity direction.

- FVG entries only inside pre-defined bias.

- Strict checklist governs every trade.

💡 Personal Takeaways

- MSS + Liquidity = my trading foundation.

- Pattern repetition is more important than precision.

- The model is simple but demands patience.

- My edge grows through annotated study journals.

- Mechanical rules protect my emotions.

📚 Glossary – Key ICT Concepts Explained

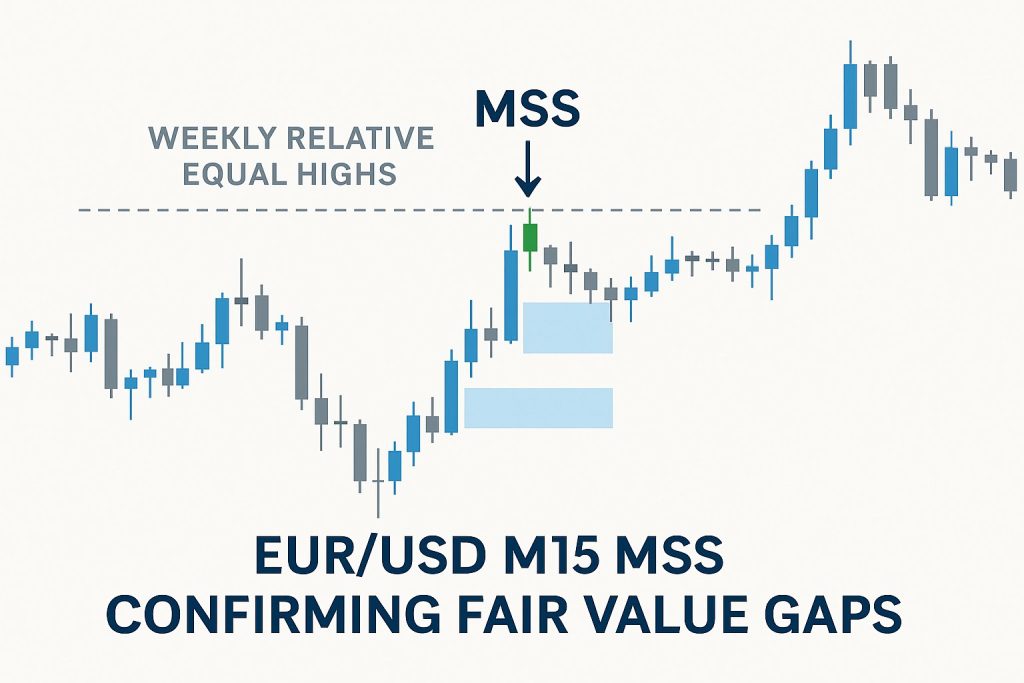

Market Structure Shift (MSS)

The key intraday signature where price reverses direction after clearing liquidity.

Order Block

A change in state of delivery where previous selling flips into new buying (or vice versa), often marked by a strong candle cluster.

Internal Range Liquidity

Short-term highs and lows within larger price swings, used as micro liquidity targets.

Liquidity Pools

The price zones where stop orders cluster:

- Buy-side: Above recent swing highs.

- Sell-side: Below recent swing lows.

Fair Value Gap (FVG)

A small price imbalance between consecutive candles that price often rebalances before continuation.

High-Frequency Algorithms

Ultra-fast algorithms that trigger trades on micro-timeframes after liquidity clears.

Change in State of Delivery

When price switches from offering liquidity on one side (sell-side or buy-side) to the other, often confirmed by MSS + OB.

🖼 Optional SEO Insert:

(Insert custom chart here illustrating Market Structure Shift + Liquidity Sweep + Order Block for SEO purposes)

⚠️ Disclaimer

These are my personal notes as an ICT student. I do not represent ICT and I’m not teaching his material — just sharing how I apply it in my trading journey. All credit for original concepts belongs to Inner Circle Trader (ICT).

👉 Learn directly from ICT: InnerCircleTrader YouTube Channel

🔗 Useful Links

- Watch the original Episode 3 on YouTube

- See all my ICT-based study notes

- See ICT Timestamps – Mentorship 2022 Episode 2 | Full Study Notes + Real Setup Breakdown

🎥 Follow My Full ICT Journey

I’m documenting everything — real notes, Forex charts, honest lessons from a student’s view.

Subscribe to TheSwedTrader on YouTube to get:

- Real Forex examples based on ICT

- Full widescreen breakdowns (16:9) + quick vertical summaries (9:16)

- Ongoing study content — no fluff, just real learning

👉 Subscribe to TheSwedTrader on YouTube

💾 Bonus tip: Bookmark this site if you’re studying ICT — I share everything.