Market Microstructure & Volume Analysis – Part 1

What’s Missing in Classic Candlestick Charts?

🔍 Why Candlesticks Aren’t Telling You the Whole Story

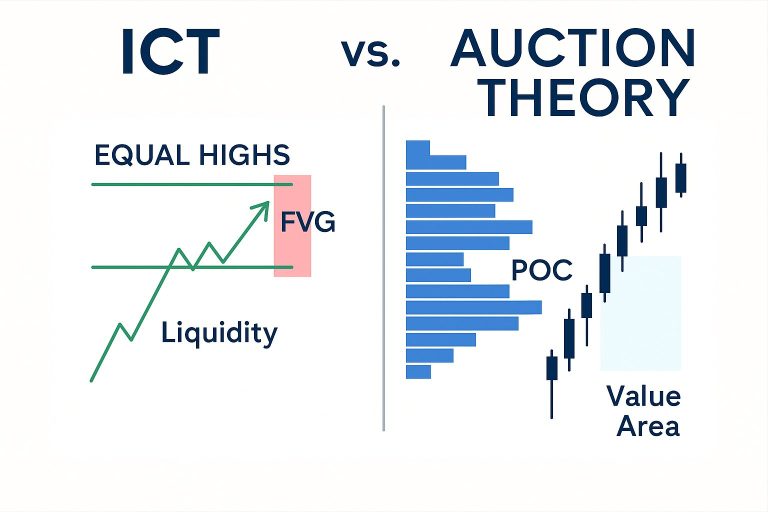

Traditional candlestick charts are useful — they show you open, high, low, and close over a period of time. But here’s the problem:

They don’t show how price moved.

Was the move driven by heavy buying or just a lack of sellers? Did price spend time trading at many levels or just spike through? Who was in control — buyers or sellers?

Candlesticks are blind to volume location and order flow.

They don’t reveal where trades happened, how many, or with what pressure.

This is the hidden dimension — and it’s why so many traders feel something is “off” when using candlesticks alone. You’re seeing the result, not the process.

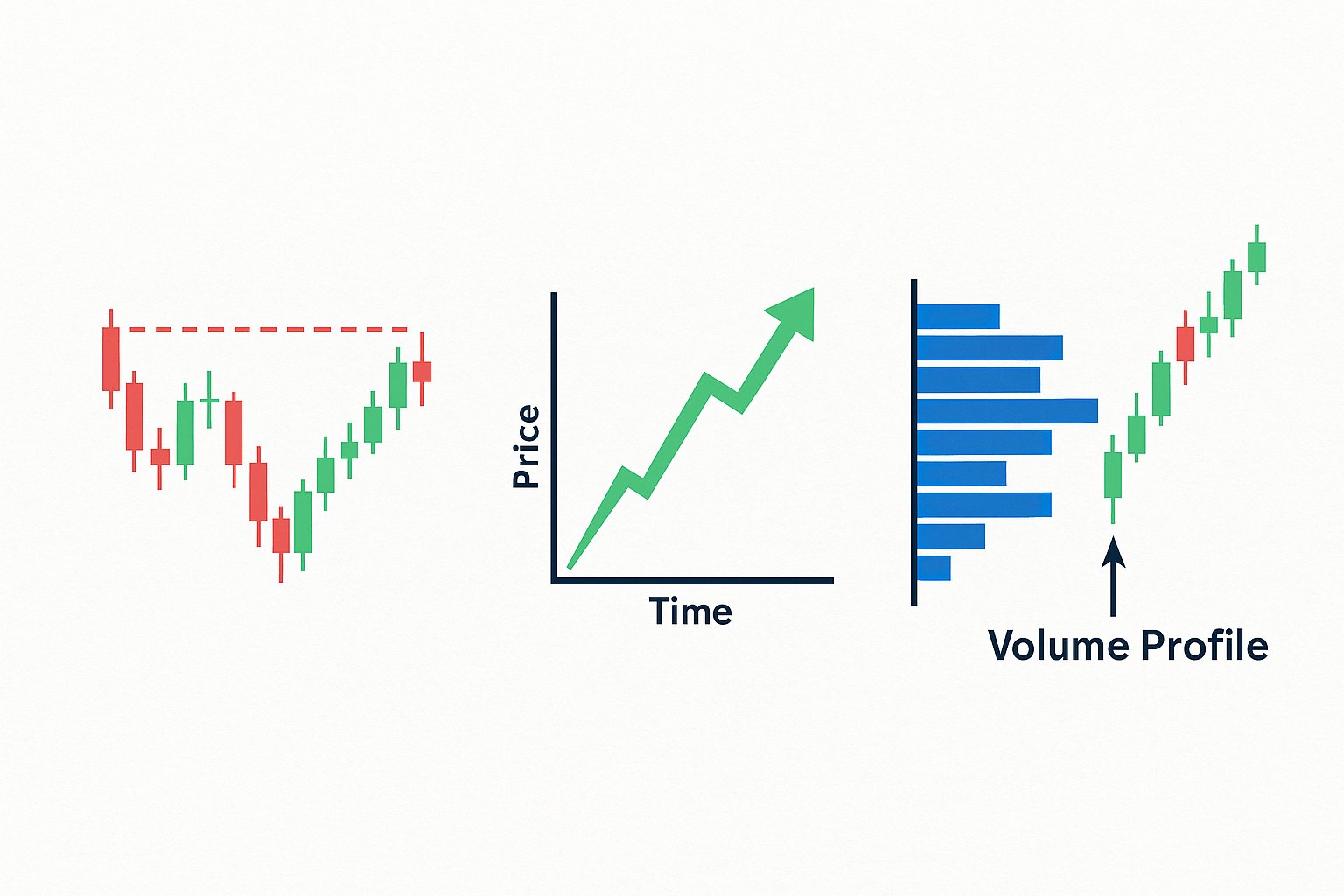

📊 What Is Volume Profile – And Why It Matters

Volume Profile is a tool that shows you how much volume was traded at each price level — not just over time.

Instead of asking:

“What did price do every 5 minutes?”

You ask:

“At which prices did the market actually do business?”

This helps you see:

- Where the market accepted price (high volume zones)

- Where it rejected price (low volume zones)

- The most traded price = POC (Point of Control)

- Value Area = the range where 70% of all volume occurred

💡 Think of it as a horizontal histogram stacked next to your candles.

Whereas candlesticks give you a story in time, volume profile gives you a story in space (price levels).

⏳ Time-Based vs Volume-Based Analysis

Here’s the key difference:

| Type | What it Measures | Pros | Blind Spots |

|---|---|---|---|

| Time-Based Charts (e.g., 5-min candles) | Price movement over time | Easy to read, standard everywhere | Doesn’t show volume effort |

| Volume-Based Tools (e.g., Volume Profile, Footprint) | Where and how trades occurred | Reveals true price acceptance/rejection | Requires more learning and custom setup |

In short:

Time-based charts show when something happened.

Volume-based tools show why and how it happened.

📘 Your Personal Takeaway

You’ve already sensed this intuitively: candles lack something essential. That “missing feeling” is valid — it’s the absence of insight into buyer/seller effort.

With Volume Profile and Footprint Charts, you’ll start to see inside the candle — like looking through an X-ray of the market’s behavior.

✅ Example Setup: Volume Profile Rejection Trade

🧠 Context

You’re trading EUR/USD during the New York session.

You’re watching a Volume Profile from the London session (or the last complete session).

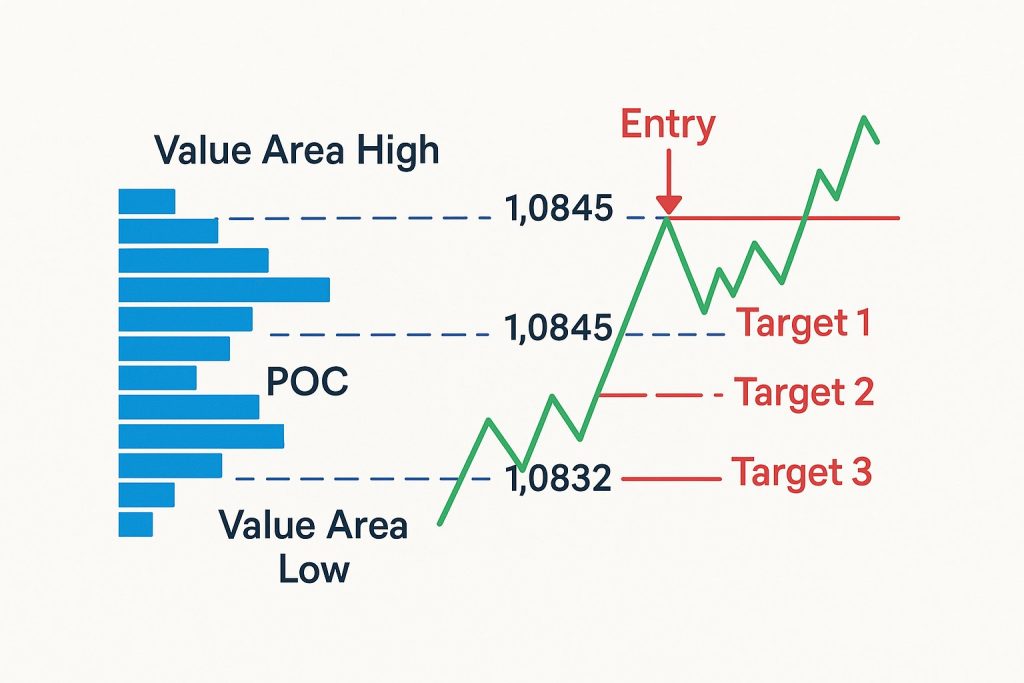

📊 What the Volume Profile Shows

| Feature | Price Level | Interpretation |

|---|---|---|

| POC (Point of Control) | 1.0832 | Market sees this as “fair value” |

| Value Area High (VAH) | 1.0845 | Upper boundary of accepted value |

| Value Area Low (VAL) | 1.0818 | Lower boundary of accepted value |

| LVN (Low Volume Node) | 1.0850 | Price was quickly rejected here = likely resistance |

🛠️ Your Trading Plan: Fade the Rejection

You notice price has been rising into 1.0850, where there’s a known LVN just above the value area high (VAH).

This tells you: Price is entering an area the market previously rejected. Sellers may step in.

🎯 Setup:

- Entry idea: Short near 1.0850 if price shows hesitation (e.g. reversal wick, footprint absorption, or lower timeframe SFP).

- Stop-loss: Just above 1.0855–1.0860 (to cover a stop run or wick).

- Target 1: Back into the Value Area High (1.0845).

- Target 2: The POC at 1.0832 – fair value.

- Target 3 (optional): Value Area Low (1.0818) – overshoot.

📉 How It Might Play Out

- Price pushes above VAH → enters low volume rejection area.

- You get footprint confirmation: buyers are aggressive, but no progress (delta divergence).

- You short.

- Price rotates back into value.

- First TP at VAH, second at POC.

🧠 Why This Works

- Markets are auction-based: when price enters an area of prior rejection (LVN), volume dries up — the market is likely to rotate back to where there is acceptance (value area).

- You’re not chasing price; you’re fading extremes with logic, not emotion.

📌 Bonus Tip:

If price breaks through the LVN and builds volume above it, this might indicate a new value area forming → time to cancel the setup or switch to breakout logic.